Medicare

How you qualify

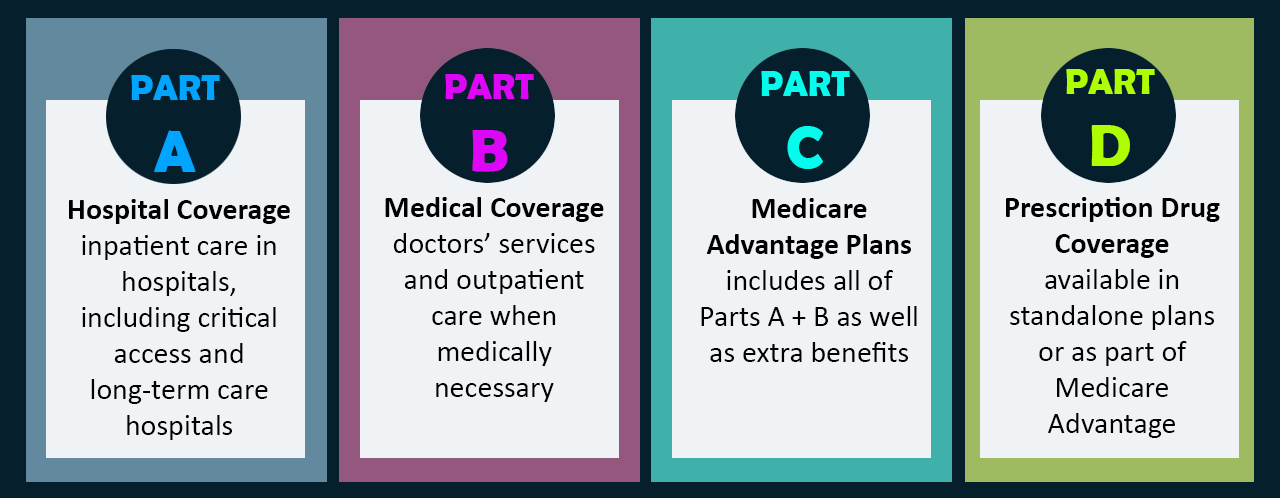

Parts of Medicare

How much does Part A cost?

Most beneficiaries will pay nothing for Medicare Part A. We all pay taxes during our working years that are specifically for our future healthcare coverage during retirement. These taxes go to offset the cost of Part A later on. As long as you have worked for 10 years (40 quarters) in your lifetime in the United States, you will generally pay nothing at all for Part A. If you or your spouse have not worked 10 years in the U.S., the monthly premium for part A is up to $422/month in 2018. People with less than 40 quarters work experience but more than 30 quarters can get a pro-rated premium.

How much does Part B cost?

If you enroll late into Part B, you may also have to pay a penalty for life. It’s important not to miss your enrollment window whenever you retire and lose access to your employer group health insurance.

You will pay a percentage of the costs of your medically-necessary Part B services. Generally, these costs are:

- the annual Medicare Part B deductible (in 2018, this is $183)

- 20% of the remaining costs, with no limits or cap

- any excess charges that a provider or facility may charge beyond what Medicare reimburses

The Need for Medicare Supplements or Advantage Coverage

These private plans charge a monthly premium and can offer coverage that protects financial assets in the event medical services needed are not covered by Original Medicare coverage. We work with many seniors and their families to understand Medicare options and provide cost breakdowns and comparisons so that they can make an informed and wise choice about Medicare plans and supplements when open enrollment hits.

Alternatives to Original Medicare

ABC Medicare Help

4101 Perimeter Center Dr

Oklahoma City, OK 73112

405-701-3148 OKC

844-940-4357 Toll Free