Parts of Medicare

Understanding Medicare

There are 4 parts of Medicare. These include Part A, B, C, and D.

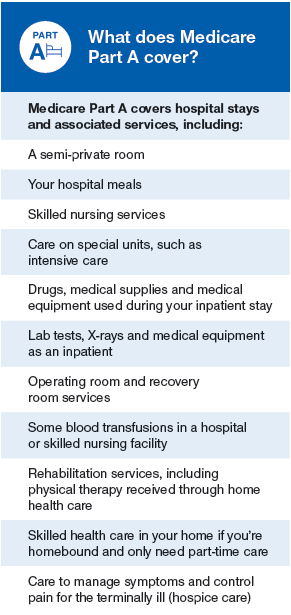

Part A covers hospital care, providing you with affordable inpatient care. It also covers post hospital care, such as skilled nursing facility care, hospice care, and home health care. Part A does not cover long-term care, such as extended stays in a nursing home. Individuals can consider purchasing long-term care insurance if this is something they want to plan for.

When do I enroll in Medicare Part A?

When do I enroll in Medicare Part A?

Enrolling in Medicare Part A is automatic for some people, particularly those already taking Social Security income benefits. When this happens, you’ll open your mailbox 2 – 3 months before you turn 65 and find your card waiting for you. You’ll want to keep your eye on the mail for your card. It is a red, white and blue card printed on heavy card stock. It is okay to laminate the card when you receive it so that it will stay in good shape over the years of being in your wallet or purse.

If you are not already receiving Social Security income benefits or Railroad Retirement income benefits yet when you turn 65, then you will need to actively sign up for Part A.

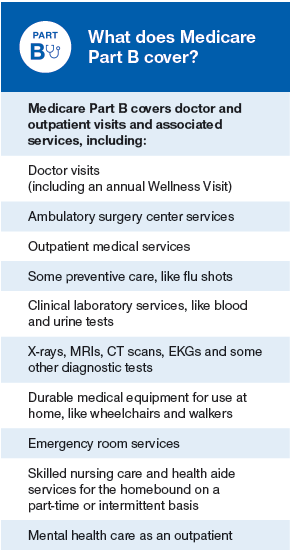

Part B is optional, and includes medical Insurance for outpatient services. Among these are doctor’s visits, laboratory testing, and advanced imaging such as MRI or CT scans. Part B also covers preventive care including flu shots, colonoscopies, mammograms and more. Finally, Medicare Part also covers more expensive services like radiation or chemotherapy for cancer, surgeries, medical equipment, and even dialysis for failing kidneys. *It may also cover clinical research, mental health services, second opinions before surgery and limited outpatient prescription drugs.

*Coverage must be determined medically necessary or preventive.

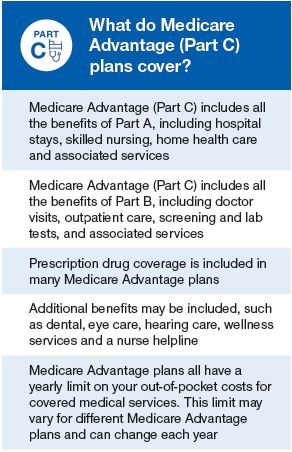

Part C, also known as Medicare Advantage Plans, includes all benefits and services covered under Part A and Part B. It is run by Medicare-approved private insurance companies, and is an alternative to original Medicare. To receive Part C benefits, you must be enrolled in Part A and B. Medicare advantage plans usually include Medicare prescription drug coverage (Part D) as part of the plan.

Why do some Medicare Advantage plans have a $0 premium?

When you enroll in a Medicare Part C Advantage plan, Medicare pays a fixed monthly amount to the plan insurance carrier to provide your care. The insurance carriers will offer you a monthly premium as low as possible to attract you to their plan. Some carriers will even offer their plan at a $0 premium to you, but this can change from year to year as each carrier must renew its contract with Medicare annually.

You will also still pay your monthly premium for Part B when you are enrolled in Medicare Advantage plans. You must be actively enrolled in both Part A and Part B to qualify for enrollment into a Advantage plan.

What are the Medicare Part C enrollment periods?

Medicare Part C annual election period begins on Oct 15th each year.

Unlike Medigap policies, you can only enroll into or dis-enroll from your plan during certain periods. You can enroll in a plan during your initial enrollment period when you first get Part B. You can also change during the annual election period each fall, which runs from October 15 – December 7th, with your benefits beginning January 1st.

The annual election period exists because if you are enrolled in Medicare Advantage or Part D, your plan’s benefits, formulary, pharmacy network, provider network, premium and/or co-payments and co-insurance may change on January 1 of each year. Medicare wants you to have an opportunity to change your plan if you don’t like the changes coming for next year.

Prescription drug coverage: Optional drug coverage for those with Part A & Part B. For those who’ve enrolled in an Advantage Plan, they must choose a plan with built-in prescription drug coverage; they cannot apply for Part D coverage separately.

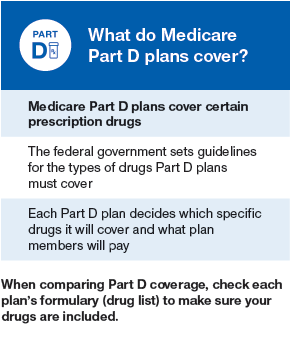

What is Part D and how does it work?

Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier’s network of pharmacies to purchase your prescription medications. Instead of paying full price, you will pay a copay or percentage of the drug’s cost. The insurance company will pay the rest.

How much does Part D cost?

Your costs for Medicare Part D vary depending on the specific drug plan that you choose. In general, you are responsible for paying a monthly plan premium. You also pay for deductibles and copays (or coinsurance) for your medications. People with higher incomes may have to pay more for their plan.

In 2018, there are many Medicare Part D plans to choose from in each state. Plans range from $15 – $170+. Choosing your drug plan should never be based on just the plan’s monthly premium. Why? Because every plan has its own separate premium, drug formulary, and copay. If you just enroll in the cheapest plan without checking the plan’s formulary, you may later learn that the plan does not cover one of your medications.

How do I enroll in Part D?

Stand-alone Medicare prescription drug plans can be purchased for a monthly premium. You use this plan alongside your original Medicare coverage. People who buy Medicare supplements will often buy a stand-alone Part D drug plan to cover their pharmacy costs.

Some Medicare Advantage plans also include built-in Part D drug coverage. It’s important to check exactly which medications a Medicare Advantage plan includes before enrolling. You want to be sure that your plan covers the medications you need.

When do I enroll in Part D?

Joining a Medicare Part D drug plan can only be done during certain windows of time. You are eligible to enroll in Part D when you first get Medicare. This window lasts seven months. It includes the three months before you turn 65, your birth month, and the three months following. A similar window exists for people who first become eligible for Medicare due to disability.

Medicare Part D also has an annual election period which runs from October 15 – December 7. During this time, you can enroll or disenroll from any drug plan. This is because each Part D plan’s benefits, formulary, pharmacy network, provider network, premiums and/or co-payments/co-insurance may change on January 1 of the following year.

The insurance company will mail you an annual notice of change so that you can review what is changing for the following year. Many people change their drug plan during the annual election period if their prescription needs have changed and another plan better suits them.

In addition, you may be eligible for a special enrollment period under certain circumstances, such as moving out of the drug plan’s service area or losing your group medical coverage mid-year.

List of Opportunity Events

[events_list limit="5" pagination="1"]